There’s a lot of confusion in the market about what’s happening with day-to-day movement in mortgage rates. So what’s up with Mortgage Rates? Here’s what you really need to know: compared to the near 8% peak last fall, mortgage rates have trended down overall. While they’re going to continue to bounce around a bit based on various economic drivers (like inflation and reactions to the consumer price index, or CPI), don’t let the short-term volatility distract you.

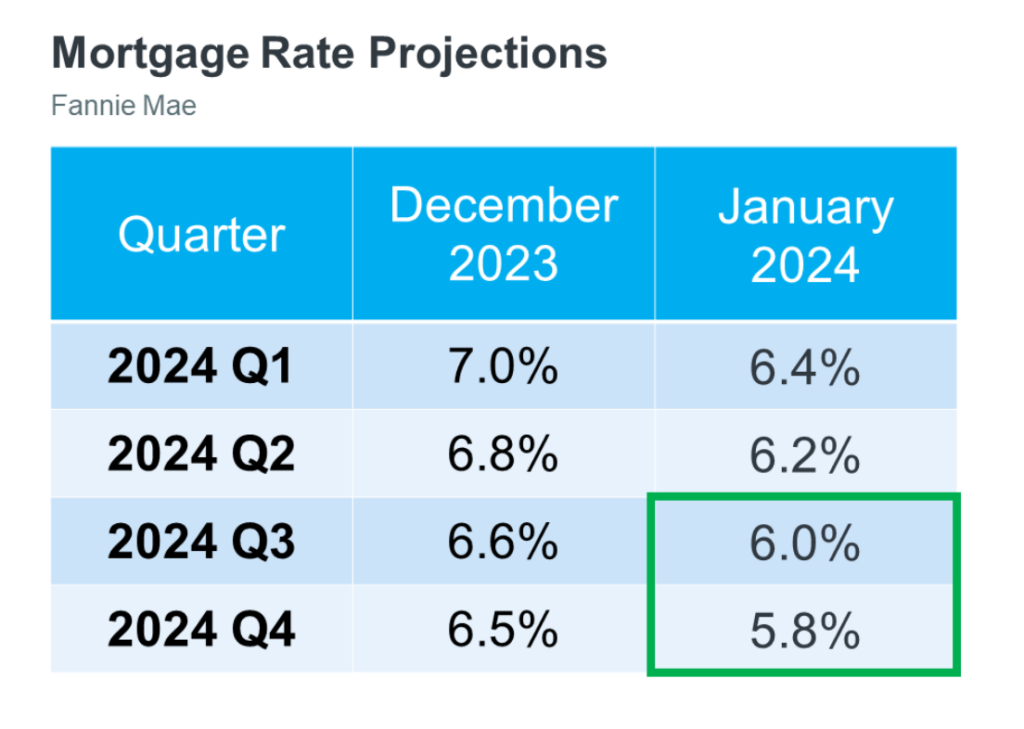

The experts agree the overarching downward trend should continue this year. While we won’t see the record-low rates homebuyers got during the pandemic, some experts think we should see rates dIt’s normal for experts to re-forecast as they watch current market trends and the broader economy, but what this shows is experts are feeling confident rates should continue to decline, if inflation cools. But remember, no one can say for sure what will happen (and by when) – and short-term volatility is to be expected. So, don’t let small fluctuations scare you. Focus on the bigger picture. If you’ve found a home you love in today’s market – especially where finding a home that meets your budget and your needs can be a challenge – it’s probably not a good idea to try to time the market and wait until rates drop below 6%.

Bottom Line If you wanted to move last year but were holding off hoping rates would fall, now may be the time to act. Let’s connect to get the ball rolling.

Jennifer Blanchard Team

Berkshire Hathaway Fox and Roach HomeServices NJ Properties